Renters Insurance in and around Boardman

Your renters insurance search is over, Boardman

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through savings options and providers on top of your pickleball league, family events and keeping up with friends, is a lot to deal with. But your belongings in your rented townhome may need the terrific coverage that State Farm provides. So when the unexpected happens, your souvenirs, linens and furniture have protection.

Your renters insurance search is over, Boardman

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

Renters insurance may seem like the least of your concerns, and you're wondering if it can actually help you. But take a moment to think about what it would cost to replace all the possessions in your rented townhome. State Farm's Renters insurance can help when windstorms or tornadoes damage your belongings.

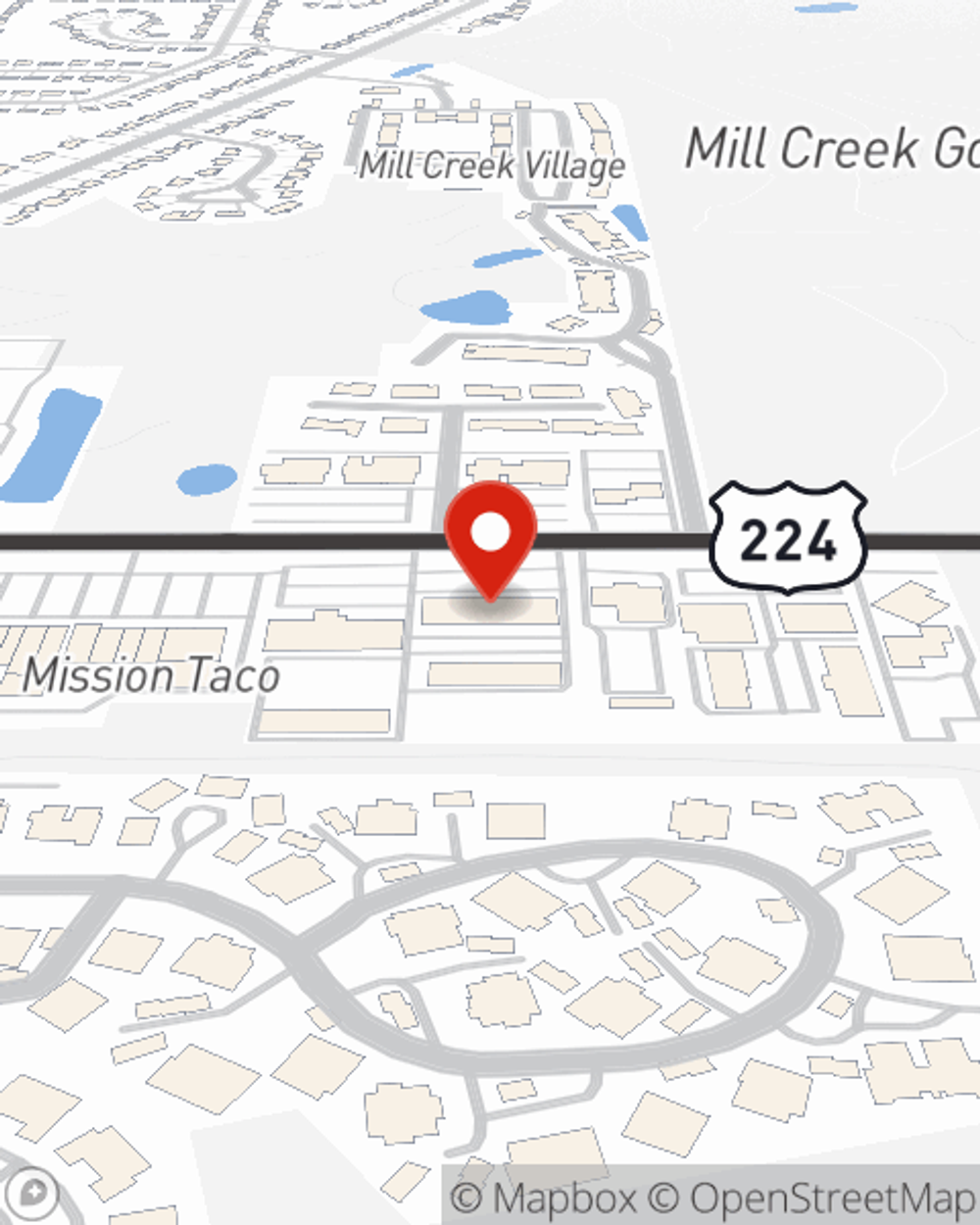

State Farm is a dependable provider of renters insurance in your neighborhood, Boardman. Reach out to agent Don Kniska today for help with all your renters insurance needs!

Have More Questions About Renters Insurance?

Call Don at (330) 758-8884 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.